File Heavy Highway Use Tax Form 2290 Returns

Heavy Highway Use Tax Deadline 2023-24

The current tax period begins July 1, 2023, and ends June 30, 2024. Heavy Highway Use Tax Form 2290s must be filed by the last day of the month following the month of first use. First use months will differ if you just purchased your rig.

Don't miss the HVUT Deadline

Who Is Required To File Heavy Highway Use Tax Form 2290 Returns?

In order to get a copy of stamped Schedule 1, you need to file IRS Form 2290 for your heavy vehicle. This only applies to highway motor vehicles that are registered in your name under state, District of Columbia, Canadian, or Mexican law at the time of its first use during a tax period. The vehicle must also have a taxable gross weight of 55,000 pounds or more in order to require the filing of HVUT Form 2290. E-filing Heavy Highway Vehicle Use Tax with ExpressTruckTax is the fastest way to get your 2290 stamped Schedule 1.

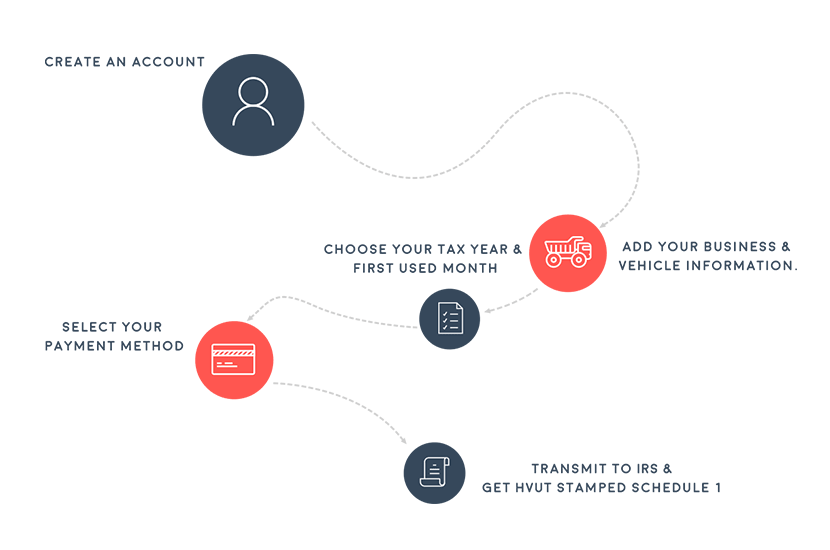

How ExpressTruckTax Works

First, you need to create an account on ExpressTruckTax.com. After that, it's only a matter of adding your business and vehicle information. With TruckZone, all of your information stays safe and secure in the cloud. When you file, you just need to choose your tax year and first used month, and then follow the steps. After you select your payment method, you can transmit your Highway use tax Form 2290 to the IRS and get your HVUT stamped Schedule 1.

Reasons to E-File Heavy Highway Use Tax Form 2290 with ExpressTruckTax

Free VIN Corrections!

Mistakes happen! If you e-filed Form 2290 with ExpressTruckTax, you can fix any VIN errors that occurred during filing for FREE! If you did not e-file your HVUT 2290 form with us, we still offer VIN corrections at a low price!

E-Sign

We’ve found a way to eliminate fax machines! If you’re e-filing on someone’s behalf, you can transmit the Excise Tax Declaration form to be e-signed. Simply send an email through our e-sign feature, and your 2290 can get transmitted to the IRS.

Re-Transmit Rejected Returns

If you’re notified of rejection after filing your Form 2290 with ExpressTruckTax, we will include the reason your HVUT return was rejected. We’ll also include instructions about how you can re-transmit your corrected return at no extra cost!

TruckZone

With TruckZone, you have the ability to upload all of your vehicles to your account and store them in one spot. With bulk uploading, you can upload a spreadsheet with all of your information and avoid manually entering an entire fleet truck by truck.

Support You Can Trust: 24/7

With our dedicated support team located in Rock Hill, SC, you know our experts are ready to handle any issue that goes their way. We have support experts ready to help available in both English and Spanish, so give us a call!