Why Should You E-file HVUT Form 2290?

Welcome to the future! Let’s leave the past behind, and say goodbye to paper filing. When you e-file your Heavy Highway Vehicle Use Tax 2290s, you reduce errors, speed up filing time, and receive your stamped Schedule 1 in just minutes. Why should you e-file with us?

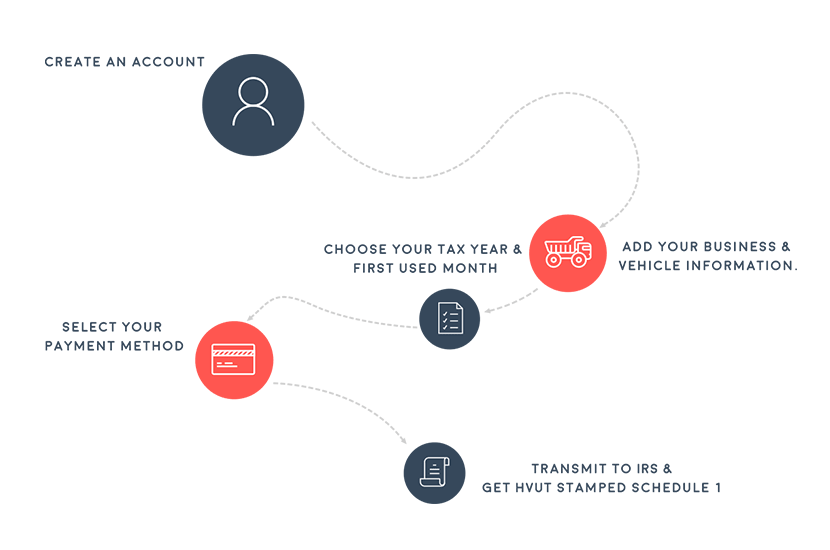

ExpressTruckTax is an easy-to-use system that will guide you through each part of the 2290 tax return process.

Best of all, we offer free VIN corrections, too!

Heavy Vehicle Use Tax Form 2290

Late Filing Penalties & Interest

According to the law, there are penalties for failing to file required Form 2290 tax returns, filing late, or filing false and fraudulent returns. The penalty for filing a return late will not be imposed if you can show reasonable cause for not filing (or paying) on time. The penalty for failing to file HVUT Form 2290 by August 31 is equal to 4.5 percent of the total tax due, assessed on a monthly basis up to five months. Late filers not making an HVUT payment also face an additional monthly penalty equal to 0.5 percent of the total tax due.There will be additional interest charges of 0.54 percent per month as well.

Don't miss the HVUT Deadline. E-FILE NOW

Why Should You File

Heavy Highway Use Tax Form 2290?

First of all, you are required to. So that’s a good start! Beyond that, the HVUT 2290 Form is used by the government to collect taxes for the upkeep and maintenance of highways and roadways used for commercial and recreational travel. Start your Heavy Vehicle Use Tax filing journey on the road that is ExpressTruckTax. We’ve simplified and streamlined Form 2290 filing by starting an e-filing revolution in the trucking industry.